San Francisco Real Estate Market Update - January 2023

Market Update

Market Update

What happened yesterday has more bearing on today than what happened five years ago, so we’re shortening our lookback window to get a better understanding of what’s to come. This isn’t to say we can’t use history or that it should be dismissed entirely; rather, the pandemic set in motion a series of events that led to a different housing market, a different overall economy, and a different world when compared to pre-pandemic times. So, as many do in the new year, we reflect on the last year and envision what’s to come.

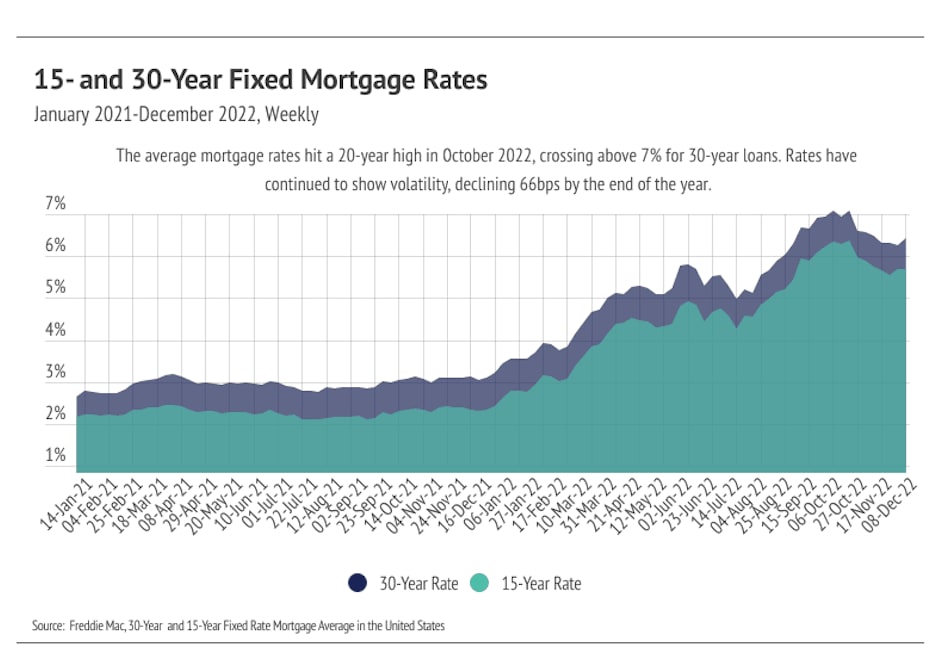

As we mentioned in the Big Story, the market has cooled for both buyers and sellers, largely because of higher interest rates. As we enter the new year, the market feels familiar — but from the era before 2020. Demand in San Francisco is evergreen, so we aren’t worried about matching buyers and sellers. That said, we’ll likely not have the frenzied buying we experienced in 2020 and 2021 anytime soon. To make a long story short, there is definitely less stress on the buying side of the market. Prices will most likely increase in 2023, but at a more modest rate of around 5-6%, which makes for a much healthier market than the volatile price movements that occurred over the past three years. Single-family home prices increased 2% over the past two years, after the 27% decline from the March 2022 peak, and condo prices were down 10% over the past 24 months after a 28% decline from the April peak. When we look back further to Q4 2019, single-family home prices have increased by 3%, while condo prices have decreased by 10%. Without any signs of interest rates dropping, we’re entering a stage of slower, longer-term growth.

When we look at single-family home and condo inventory levels for 2021 and 2022 side by side, it’s immediately apparent that inventory levels in any given month were fairly similar, but the markets were quite different. The 2021 market was defined by the high demand and high number of new listings, which helped drive a huge number of sales. New listings and sales rose and fell in tandem, but sales significantly outpaced new listings at the end of 2021, which dropped inventory to extremely low levels. In 2022, however, far fewer listings came to market, especially in the second half of the year. Fewer homes and the rising rate environment dropped demand, but the sharp decline in new listings in the fourth quarter was far greater than sales. Inventory levels for single-family homes and condos closed the year lower than the previous. This year, we expect the housing market to look a lot more like 2022 than 2021, with fewer new listings and sales.

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). MSI has trended higher in the second and third quarters of 2022 but reversed in the fourth quarter as inventory dropped, indicating that San Francisco is in a sellers’ market for single-family homes. Although condo MSI currently implies a balanced market, MSI will likely trend lower. Despite the changing economic environment, we are comfortable saying that the market will still favor sellers for at least the first quarter of 2023.

Stay up to date on the latest real estate trends.

You’ve got questions and we can’t wait to answer them.