-

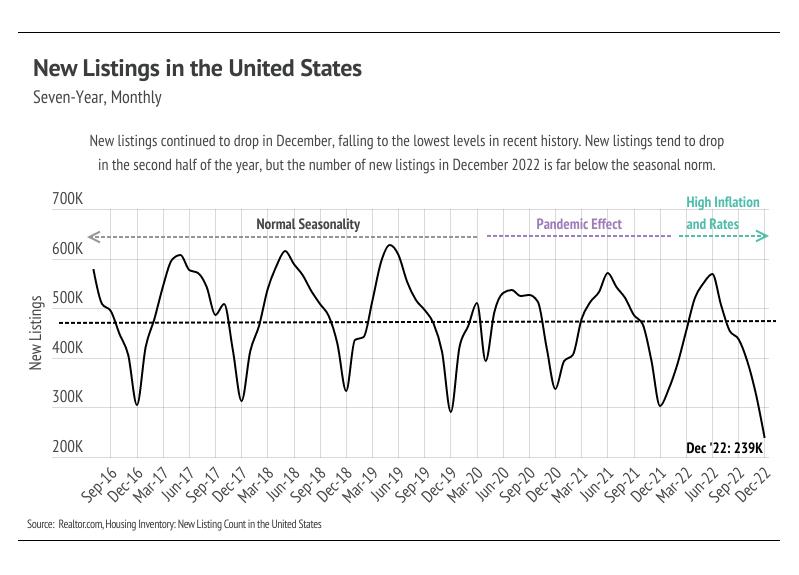

The North Bay housing market is once again at an all-time-low inventory level as far fewer new listings are coming to market.

-

Single-family home prices are showing some early signs of stability, while condo prices continue to show volatility.

-

As the monthly mortgage cost has increased over the past year, all markets have been affected, but single-family homes in Marin have decreased most significantly, down 37%.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

|

|

|

Low supply will be the norm for at least six months

|

|

|

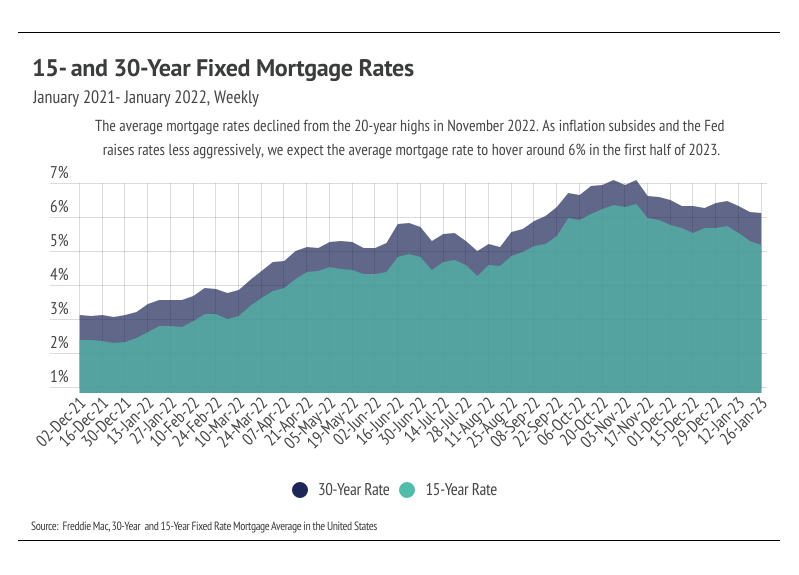

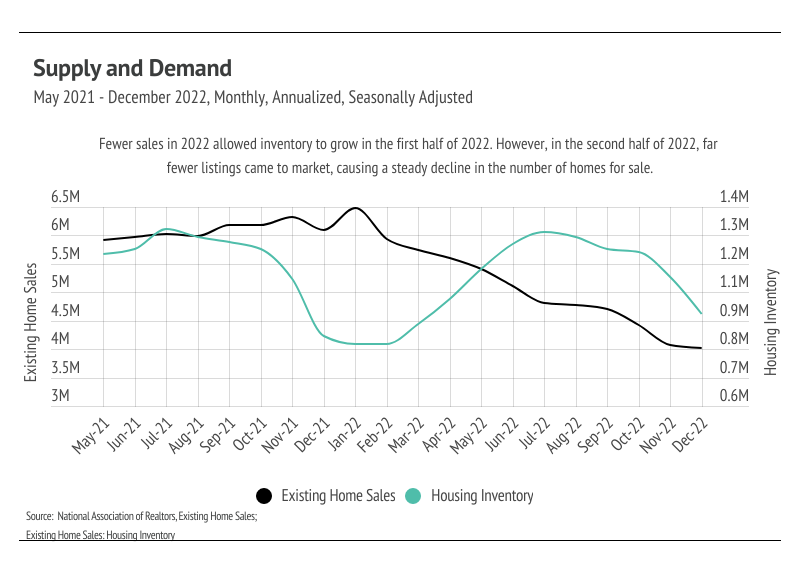

We have enough data to see the trajectory for the next few months, if not the next year. The housing market hasn’t come to a grinding halt — people will always need to move for an assortment of reasons — but it has slowed considerably, largely due to financing costs and the aftermath of the buying frenzy from mid-2020 to mid-2022. The 2020-2022 housing market was very efficient compared to now. Real property tends to be much further toward the inefficient side of the spectrum for a slew of reasons: the unique nature of every home, finite amount of land, building expense, number of market participants at any given time, high cost, long holding period, and opaque pricing, which creates a relatively illiquid market. However, the homebuying incentives and dramatic increase in disposable income during the 2020-2022 period shifted the market to a state of ultra-high demand relative to supply, which in turn created a highly liquid market. Homes sold quickly with multiple offers above list price, driving prices to record highs. The majority of buyers finance their homes through a mortgage loan; this made rising prices less financially impactful when rates went down and significantly more impactful as rates rose.

The price and the cost were at odds. For example*, if you took out a $100,000 30-year mortgage in January 2020 at the average rate of 3.51% for the full cost of the home, the principal and interest you’d pay per month was around $449. By December 2021, that home price rose to $130,200 and the average 30-year rate fell to 3.11%, so if you bought that home in December at 3.11%, the cost per month was $564, a 25.6% increase despite the price increasing 30.2%. If we fast-forward to the present, that home now costs about $135,000 — but mortgage rates have increased significantly, now 6.09%, so the monthly cost increases to $817 per month. In short, when we account for price increases and rate increases, the price of a home has increased 82% over the past three years. Every market has had different levels of price appreciation and contraction in the recent past, but everyone currently faces higher mortgage rates.

Single-family home and condo prices have still increased over the past three years despite the contraction over the past six months, so it’s reasonable to assume that the market will continue to slow. We’re expecting fewer sellers coming to market and fewer buyers this year.

*We’re using the Case-Shiller 20-City Composite Home Price Index to create an illustrative home price.

|

|

|

Depressed seasonal norms for inventory

|

|

|

Single-family home and condo inventory fell near all-time lows in January 2023. Higher interest rates have dropped incentives for potential sellers and buyers to enter the market. Homeowners either bought or refinanced recently, locking in a historically low rate, so fewer listings are coming to market. Many potential buyers were priced out of the market as interest rates rose. New listings fell by 36% year-over-year, while sales declined by 39%. We still expect some inventory growth in the first half of the year, but inventory will likely remain low.

|

|

|

Months of Supply Inventory implies a sellers’ market for single-family homes and condos

|

|

|

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). MSI for the entire North Bay moved higher again in January, nearing balance for single-family homes but still a sellers’ market, while the condo market favors buyers. When we look at individual counties, MSI indicates a mostly sellers’ market with the exception of Napa single-family homes, which is a buyers’ market, and Marin condos, which is balanced.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|